Get the best experience and stay connected to your community with our Spectrum News app. Learn More

Continue in Browser

Get hyperlocal forecasts, radar and weather alerts.

Please enter a valid zipcode.

Save

CLEVELAND — Homeownership for Black Americans is significantly lower than for other races.

A Harvard study shows around 45% of black Americans own a home, compared to nearly 75% of white Americans.

There are a lot of reasons for the disparity.

Since the pandemic, home purchases dropped drastically among all races, but the African American race has one of the lowest number of homeowners. Lack of knowledge is one of the top reasons.

“I was financially ready. Educationally, I was not," said Candice DuBose, a minority homeowner.

Buying a home involves preparation and being ready to sign on the dotted line when it’s closing time.

“It was the biggest decision I had made, but the smartest decision I made," said DuBose.

DuBose bought her home several years ago, and for her, it was a part of starting a new journey. Like many Black home buyers, DuBose had a few setbacks at first.

“I didn’t know about the first-time homebuyer programs I could have a better part of, and then additionally, I didn’t understand the loans that I had available to me," said DuBose.

National Association of REALTORS reports in 2024, first-time homebuyers represented 24% of all homebuyers. This was the lowest percentage in history since tracking began in 1981.

Real estate investor Joshua Parker said there are several key reasons Black people have lower homeownership.

“There’s too much money going out, and there’s simply not enough money coming in to sustain the purchase," said Parker. “Also, the credit score. The credit score is either too low to afford a property or the credit score is simply too low to the point that it drives the interest rates so high that it reduces the type of home or the value of a home one can acquire.”

National real estate company Redfin states Black homeownership declined this year to 43.9% between April and June. That time last year, it was at 45.3%. That’s compared to 74% of white Americans owning a home and around 63% of Asian/Native Hawaiian/Pacific Islanders.

“There are a lot of resources and programs that are available to assist many first-time homebuyers individuals who are looking to engage in financial transactions with real estate," said Parker.

Brandi Nichols, a real estate agent with Eberhardt Realty and the founder of the Wealth and Wellness Summit, says not knowing can be the biggest reason Black buyers aren’t closing.

“We’re just not provided with the resources or the education like the other ethnic groups have, and also the benefits … we just don’t know the benefits of homeownership," said Nichols.

For buyers like DuBose, setbacks happen and barriers exist, but she did what Parker and Nichols both suggest to overcome them.

“We just need to get out in the community," said Nichols. “Host these different events, have these seminars so that we can educate our people, and then we can give them the tools they need to become homeowners.”

“I’ve really leaned into education, so I’m ready for my second home," said DuBose.

Both Parker and Brandi say buying a home can be risky, but benefits like building wealth outweigh the cons.

Different banks, credit union and real estate agencies offer homebuyer classes. Seminars like the Wealth and Wellness Summit offer participants education and a chance to ask questions to get them closer to homeownership and becoming financially literate.

African American homeownership the lowest among races – Spectrum News 1

More Stories

Holland America Line Sets New U.S. Bookings Mark with Record Black Friday Weekend Sales – PR Newswire

National Parks Now Free on Trump’s Birthday, but Not on Black Holidays – Yahoo

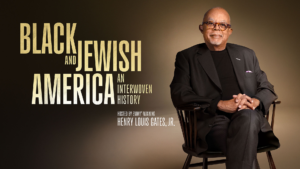

Henry Louis Gates Jr. Explores the Connection and Conflict Between Black and Jewish Americans: ‘A Formidable Force – Yahoo News Canada